The Best Stock Of RJ Minimized His Wealth

Jul 10, 2019 | 17:56 PM IST

Jul 10, 2019 | 17:56 PM IST

Titan Company share price marked the largest single-day fall in over 6 years. The fall came after the maker of Titan watches and Tanishq jewellery said that first quarter of the current fiscal saw a tough macro-economic environment with consumption taking a hit. The jewellery-to-watch maker mentioned that very high gold prices particularly in June impacted growth in the jewellery industry.

Shareholders of Titan have almost lost over Rs 15,000 crore in a trade with its market capitalisation falling to Rs 96,058 crore.

Titan Company share price has gained 21.31% since the beginning of this year. In contrast, the 30-share Sensex rose 7.5 % since the beginning of this year and 7.38% during the last one year.

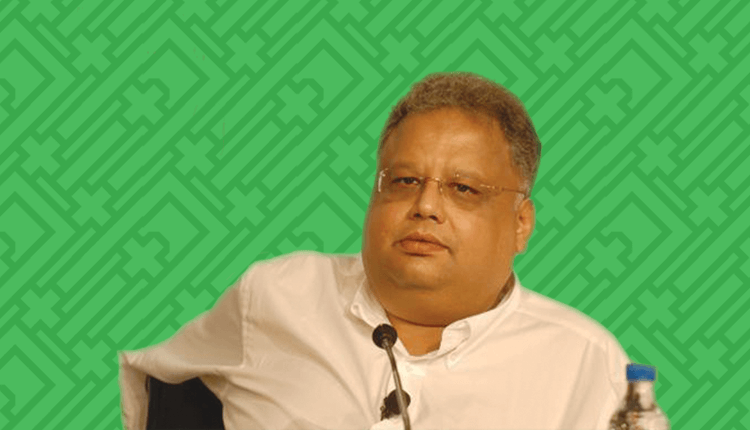

Ace investor Rakesh Jhunjhunwala holds around 5.7% stake in the firm at the end of March quarter. Moreover, Rekha Jhunjhunwala owned 1.3% shares of Titan Company during the period.

The firm said revenue from jewellery grew by a muted 13% in the first quarter of 2019 as sharp surge in gold prices dented consumer demand significantly in the month of June.

Titan Company reported a 14.4% growth in its consolidated net profit for the quarter ended March 31. Total revenue grew 19.87% at Rs 4,945 crore compared to Rs 4,125 crore on YoY basis.

Titan Company is involved in offering watches, jewellery and others. The company's segments include watches, jewellery, eyewear and others. The company offers plain and studded gold jewellery brands, such as Tanishq, GoldPlus, Zoya, Mia, which are retailed through Tanishq, GoldPlus, Zoya and Mia stores. The Company offers watches and accessories, such as bags, sunglasses in brands, including Titan, Sonata, Fastrack and sub brands, such as Raga, Xylys and Edge, among others.

Now Follow Rakesh Jhunjhunwala's Latest Portfolio, Holdings And Track his Picks With Us. To Know His Latest Stock Picks Read Rakesh Jhunjhunwala's Latest Portfolio, Holdings, And Picks 2019